The trading fees on Delta are mainly charged on the Notional Size of the trade.

Formula:

Notional Size = Spot Price × Quantity

Example: Options

Let's assume a trader buys 300 contracts of BTC USDT option at a strike price of $26,000 while BTC is trading at $26,200.

1 contract of BTC = 0.001 BTC

300 contracts of BTC = 300 × 0.001 = 0.3 BTC

Hence, the notional size = 26,200 × 0.3 = $7,860

Example: Futures

Let's assume a trader buys 300 contracts of BTC USDT futures at a price of $26,200.

1 contract of BTC = 0.001 BTC

300 contracts of BTC = 300 × 0.001 = 0.3 BTC

Hence, the notional size = 26,200 × 0.3 = $7,860

Fees in Options Trading (Options and Move Contracts)

Usually, the trader will only be paying the Taker/Maker fees while opening or closing a position.

This fee remains fixed.

Taker/Maker Fees: 0.03% of the Notional Size

Taker fee is a trading fee charged to traders who take liquidity from the order book by executing trades that are immediately matched with existing orders.

Maker fee is a trading fee charged to traders who provide liquidity to the order book by placing limit orders that are not immediately matched with existing orders.

Fee Capping Feature Advantage (12.5% of Premium)

Delta Exchange offers a fee capping feature where the trading fee is capped at a maximum of 12.5% of the premium on options contracts.

This fee capping advantage can benefit traders who deal with Deep OTM options which have low premium.

Fee Calculation (Options Example)

Let's assume a trader buys 300 contracts of BTC USDT OTM option at a strike price of $26,000 at a premium of $15, while BTC is trading at $26,200.

1 contract of BTC = 0.001 BTC

300 contracts of BTC = 300 × 0.001 = 0.3 BTC

Hence, the notional size = 26,200 × 0.3 = $7,860

Premium Paid = Qty × Premium = 0.3 BTC × $15 = $4.5

Since the taker/maker fees is 0.03%, the fee would have been 0.03% × $7,860 = $2.358.

However, 12.5% of the premium for this trade is 12.5% × $4.5 = $0.5625.

Since this is less than $2.358, the user will only pay $0.5625 as the trading fees.

The premium capping will be eligible only when the taker/maker fees based on the notional size is more than the fees based on the 12.5% premium calculations.

NOTE: The calculation will stay the same even in case of option selling.

Fees in Futures Trading (Inverse/USDT Linear Futures)

Usually, the trader will only be paying the Taker/Maker fees while opening or closing a position.

This fee remains fixed.

Unlike options, the maker fee in futures is 0.02% less than the taker fee. Hence, a user can take advantage of the lower maker fee by ensuring they take a Maker Order.

Taker Fee: 0.06% of the Notional Size

Maker Fee: 0.04% of the Notional Size

Fee Calculation (Futures Example)

Let's assume a trader buys 300 contracts of BTC USDT futures at a price of $26,200.

1 contract of BTC = 0.001 BTC

300 contracts of BTC = 300 × 0.001 = 0.3 BTC

Hence, the notional size = 26,200 × 0.3 = $7,860

Fees for Taker Order = 0.06% × $7,860 = $4.716

Fees for Maker Order = 0.04% × $7,860 = $3.144

NOTE: The calculation will stay the same even in case of a sell order.

Frequently Asked Questions (FAQs)

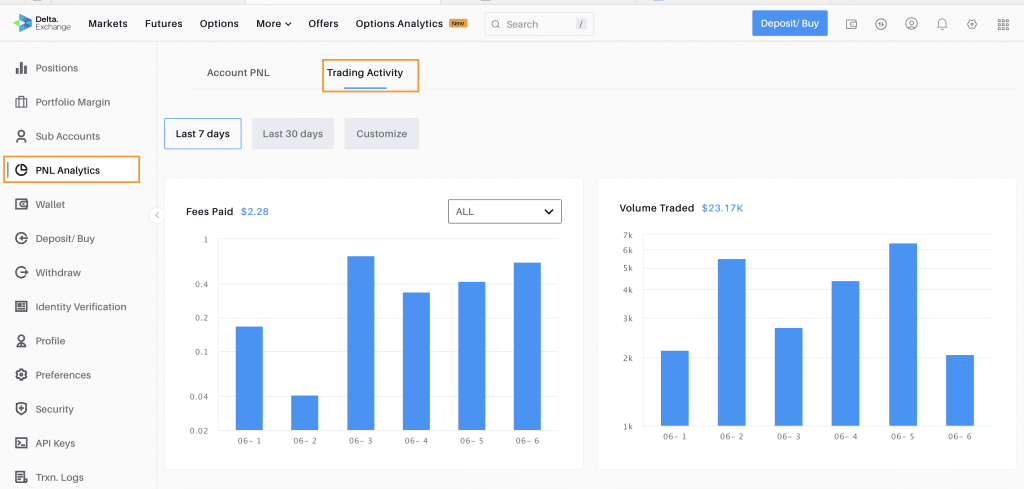

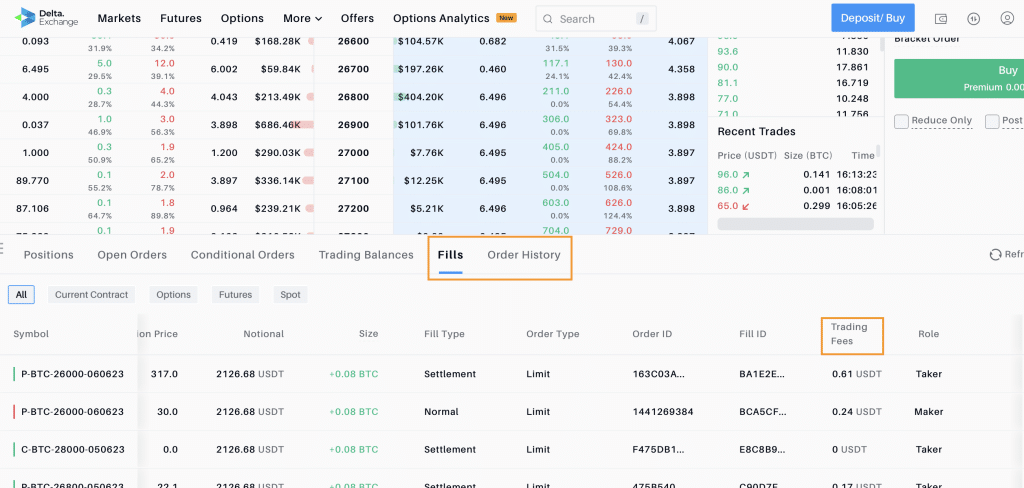

Where can I see fees paid in my account?

You can check fees paid for individual trades in the Fills or Order History section.

To check the overall fees paid, please check the Trading Activity section in the PNL Analytics page.

Does leverage affect trading fees?

No, leverage does not affect trading fees.

Which Margin Mode attracts the least trading fees?

Trading fees are independent of the margin mode. Hence, the fees will remain the same irrespective of which margin mode you trade in.

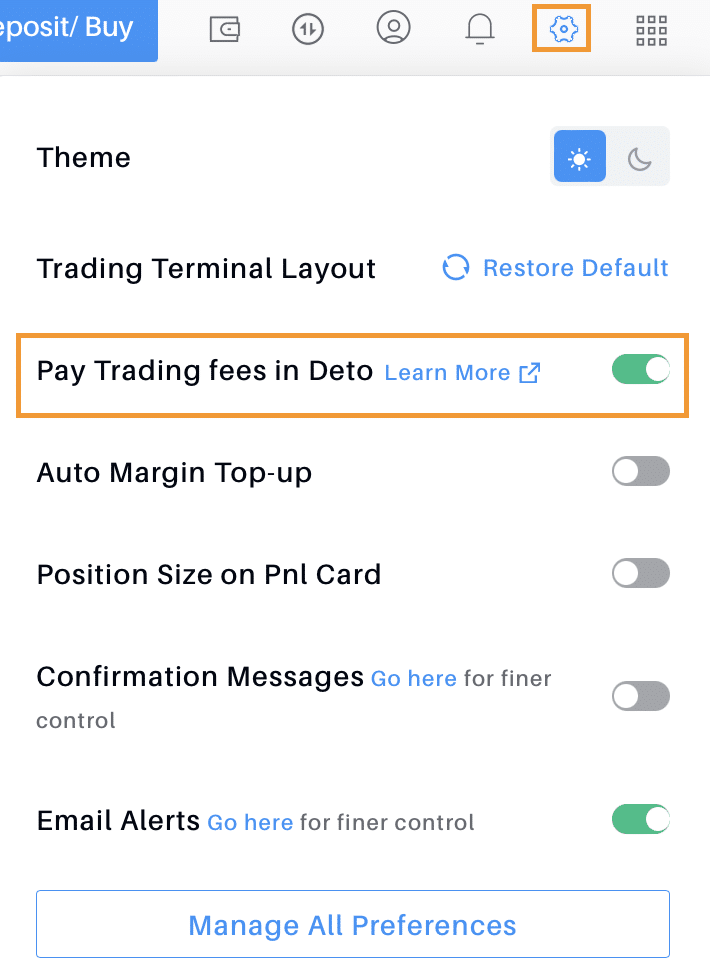

What is DETO and how is it used to pay fees?

DETO is the utility token of Delta Exchange. Earn DETO through trade farming, liquidity mining, or referral mining.

You can use DETO to pay 25% of the trading fee per trade, but only if you have enabled the ‘Pay trading fees in DETO’ option under Manage Preference.

What is the Settlement Fee?

Settlement fee is the fee charged when an open position in a futures or options contract is automatically settled at expiry.

All settlement trades are processed as taker trades, and hence taker fee is applicable.

Futures: Settlement fee = 0.06%

Options: Settlement fee = 0.03%, capped at 12.5% of premium

The premium cap ensures that options expiring worthless do not incur any settlement fees.

How much trading fees do I need to pay if my option contract expires worthless?

We do not charge any trading fees if the option contract you were holding expires worthless.

Why are the Options trading fees high compared to Bank-Nifty (India) options?

Crypto options trading fees are slightly higher due to factors like market volatility, liquidity challenges, regulatory considerations, etc.

Rest assured, we offer the best possible rates while ensuring a user-friendly experience.